Subsidized and unsubsidized loans are both forms of financial aid. When you complete your FAFSA, you school may offer you loans. Loans aren’t free money. They must be paid back with interest. Whenever possible, we advise students to avoid accepting loans.

What’s the difference between the two?

While you are in school, the government pays the interest on your subsidized loans. With unsubsidized loans, you are expected to pay the interest on your loans. If you do not pay it while you are in school (and who does that?) the unpaid interest gets added back into your loan.

How much interest accumulates? It depends on how much money you borrow and what your interest rate is.

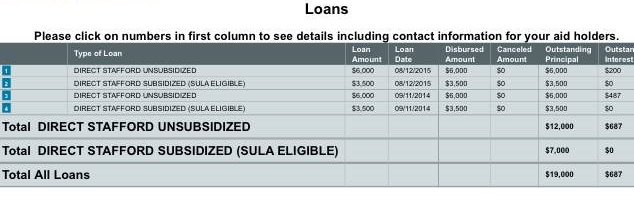

The example below is a student’s student loan information from 2018. This student accumulated almost $700 in debt on $12,000 in loans in 3-4 years. Fortunately, he only took out loans for 2 years of school, before switching to a more affordable school. Every year that he does not pay, he accumulates more interest.

This student will probably have a monthly loan payment of $300, every month for the next 10 years. Think about what you could do with an extra $300 a month!

This student will probably have a monthly loan payment of $300, every month for the next 10 years. Think about what you could do with an extra $300 a month!